Gold bulls eye $1,930 on economic slowdown, US-China jitters amid US holiday …

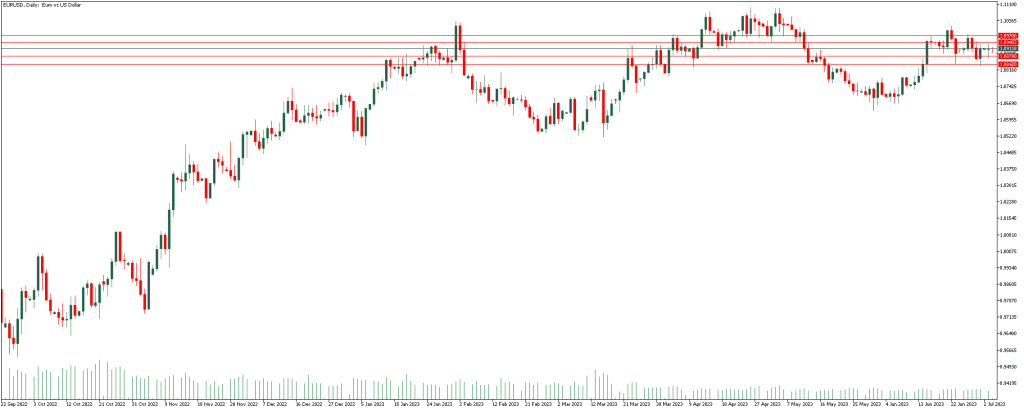

EURUSD

EUR/USD is trading close to 1.0900, holding lower ground in early Europe. The main currency pair is facing selling pressure as the market mood turns cautious and underpins the safe-haven US Dollar. Thin trading to extend on the US Independence Day.

If the pair continues the uptrend to the range of 1.0942, it is expected to continue the uptrend to the range of 1.0970.

On the other hand, If the pair continues the downtrend to the range of 1.0878, it is expected to continue the downtrend to the range of 1.0842.

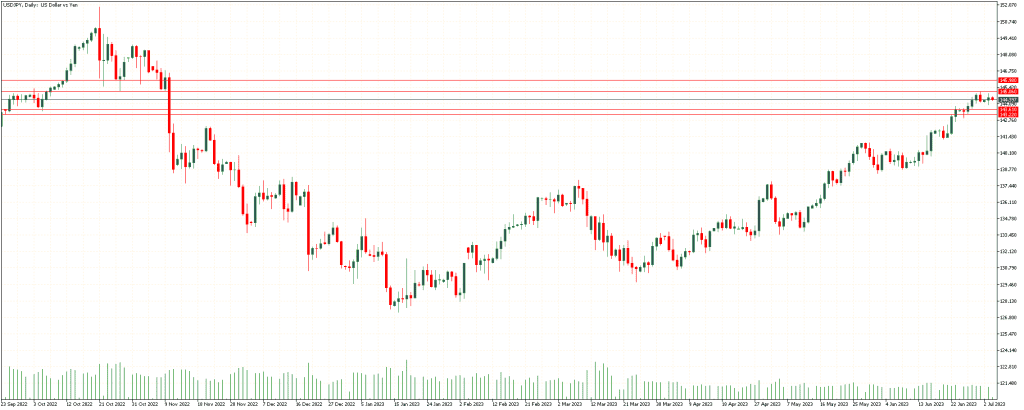

USDJPY

USD/JPY is trading on the back foot around 144.50 after the Japanese Yen received some respite on the verbal intervention from the country’s top currency diplomat Kanda. The downside appears limited amid the BoJ-Fed policy divergence and ahead of key US data.

if the pair continues the uptrend to the range of 145.06, it is expected to continue the uptrend to the range of 145.98.

On the other hand, If the pair continues the downtrend to 143.61, it is expected to continue the downtrend to 143.22.

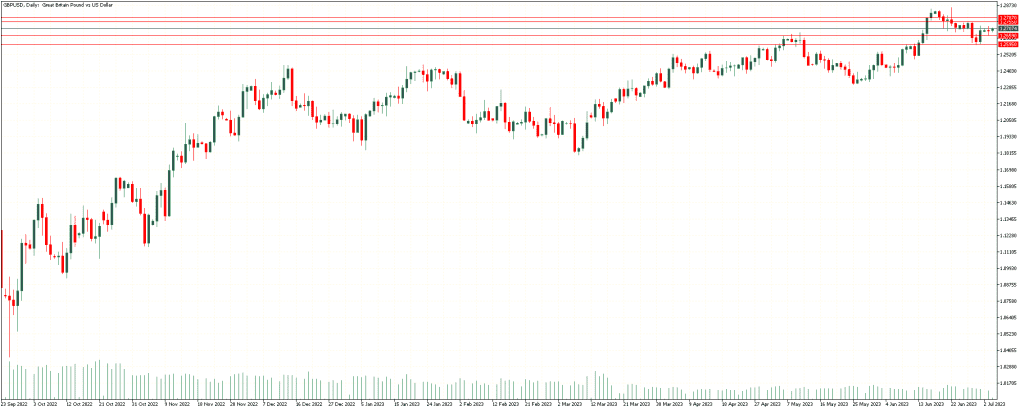

GBPUSD

If the pair continues the uptrend to the range of 1.2755, it is expected to continue the uptrend to the range of 1.2787.

On the other hand, if the pair continues the downtrend to 1.2659, it is expected to continue the downtrend to 1.2595.

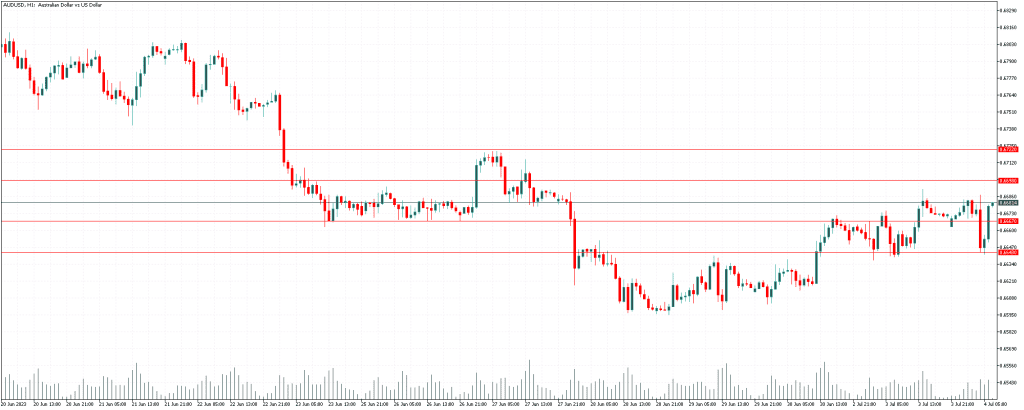

AUDUSD

AUD/USD has come under fresh selling pressure and trades below 0.6650 after the Reserve Bank of Australia (RBA) left the Official Cash Rate (OCR) unchanged at 4.10%, disappointing the hawks. The RBA, however, left doors open for further tightening later this year.

If the pair continues the uptrend to the range of 0.6698, it is expected to continue the uptrend to the range of 0.6722.

On the other hand, if the pair continues the downtrend to 0.6667, it is expected to continue the downtrend to 0.6643.

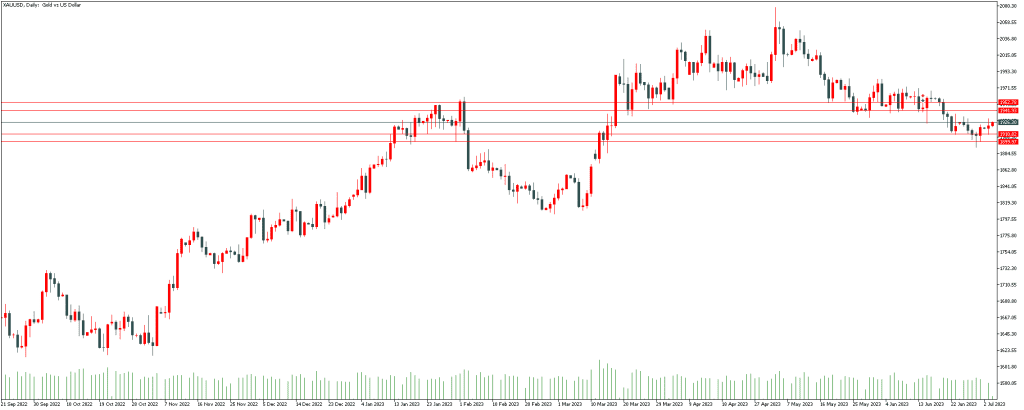

XAUUSD

Gold Price (XAU/USD) stays on the front foot for the fourth consecutive day despite lacking upside momentum around $1,923 heading into Tuesday’s European session.

If the pair continues the uptrend to the range 1941.93, it is expected to continue the uptrend to the range of 1952.78.

On the other hand, if gold continues the downtrend to the range of 1910.82, it is expected to continue the downtrend to the range 1899.97.