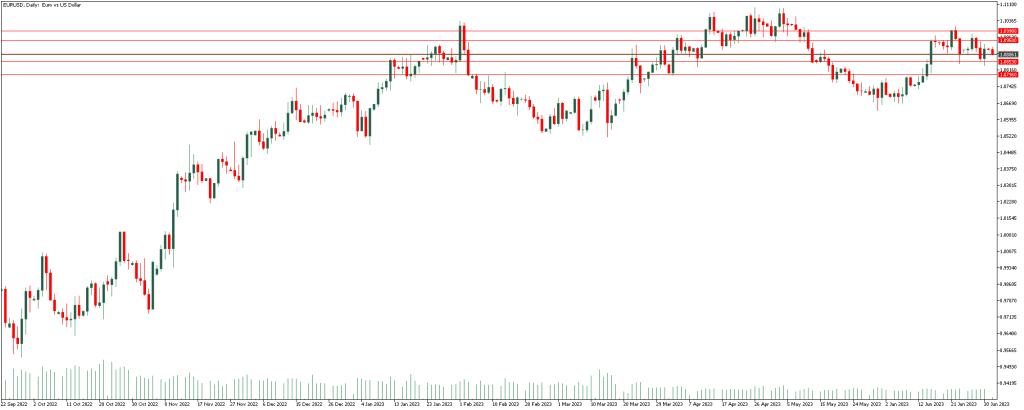

EURUSD

EUR/USD is holding steady above 1.0900, defending the latter ahead of the European Open. The pair is looking for a fresh directional impetus amid thin trading conditions and ahead of the Eurozone final PMIs and the top-tier US ISM Manufacturing PMI.

If the pair continues the uptrend to the range of 1.0950, it is expected to continue the uptrend to the range of 1.0990.

On the other hand, If the pair continues the downtrend to the range of 1.0853, it is expected to continue the downtrend to the range of 1.0796.

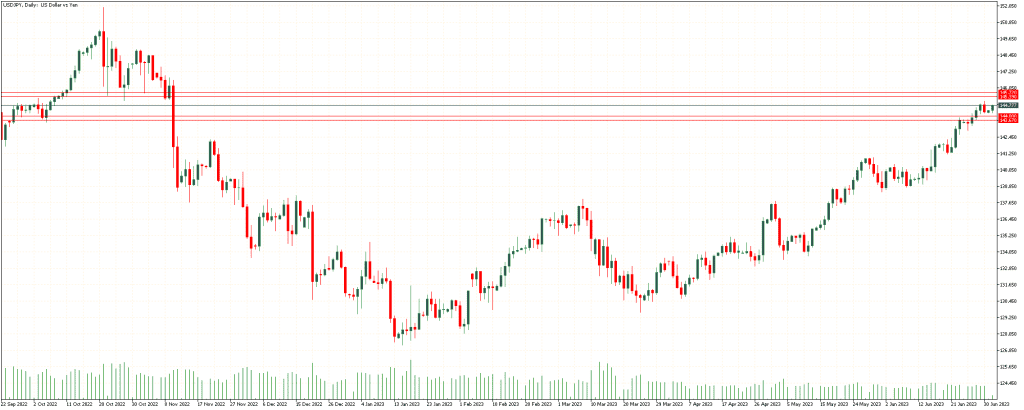

USDJPY

USD/JPY seesaws around 144.60 as it seeks fresh clues to defend intraday gains amid a sluggish start to another key trading week. The Yen pair reverses the previous day’s retreat from the highest levels since November 2022 amid mixed risk catalysts and downbeat Japan data.

if the pair continues the uptrend to the range of 145.39, it is expected to continue the uptrend to the range of 145.72.

On the other hand, If the pair continues the downtrend to 144.00, it is expected to continue the downtrend to 143.67.

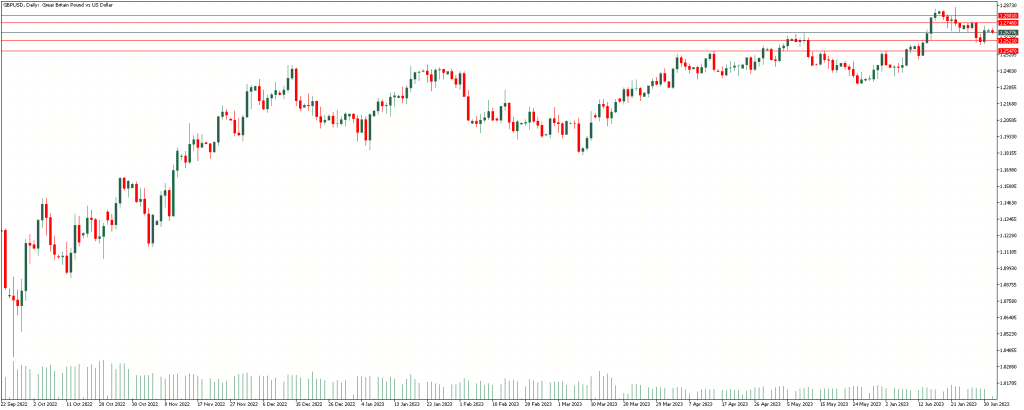

GBPUSD

If the pair continues the uptrend to the range of 1.2748, it is expected to continue the uptrend to the range of 1.2801.

On the other hand, if the pair continues the downtrend to 1.2621, it is expected to continue the downtrend to 1.2547.

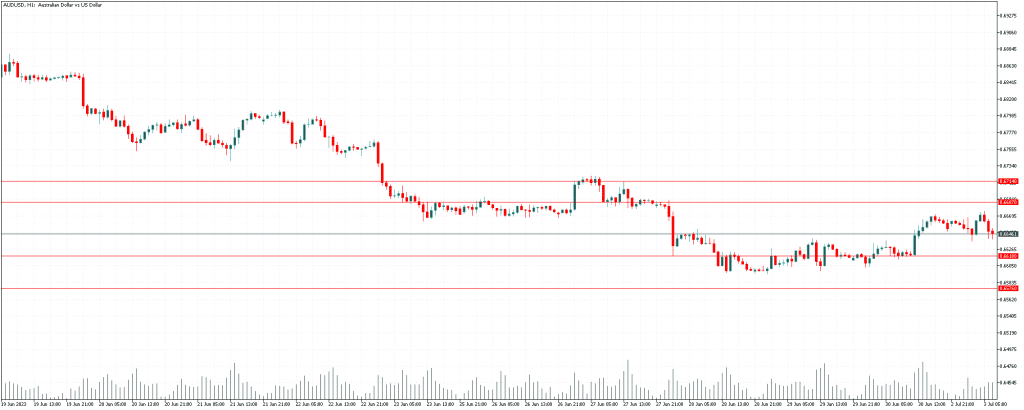

AUDUSD

AUD/USD bulls struggle around the intraday high of near 0.6665-70 as a short-term key upside hurdle prods the risk-barometer pair’s three-day winning streak amid early Monday in Europe. The Aussie pair justifies the trader’s anxiety ahead of Tuesday’s Reserve Bank of Australia (RBA) Interest Rate Decision.

If the pair continues the uptrend to the range of 0.6687, it is expected to continue the uptrend to the range of 0.6714.

On the other hand, if the pair continues the downtrend to 0.6618, it is expected to continue the downtrend to 0.6576.

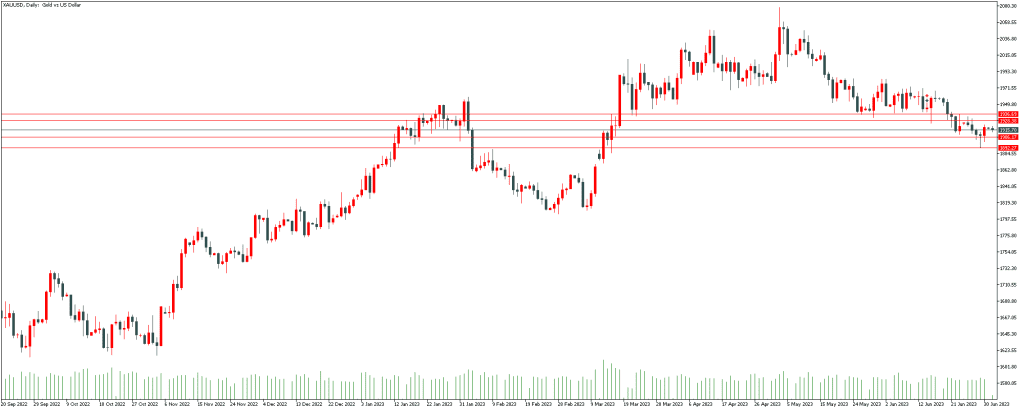

XAUUSD

Gold Price struggles to extend late last week’s corrective bounce off the three-month low as market players await top-tier data events. Also acting as trading filters for the XAU/USD are mixed concerns about the US Treasury Secretary Janet Yellen’s China visit.

If the pair continues the uptrend to the range 1928.38, it is expected to continue the uptrend to the range of 1936.69.

On the other hand, if gold continues the downtrend to the range of 1906.17, it is expected to continue the downtrend to the range 1892.27.