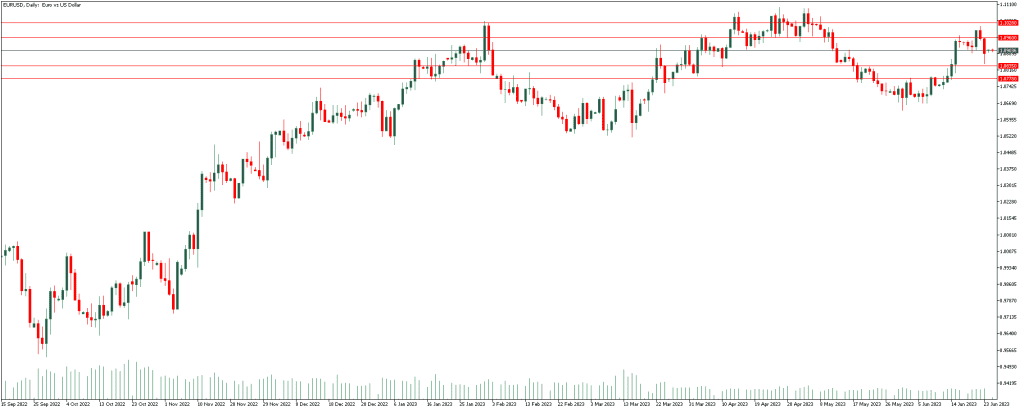

EURUSD

EUR/USD is hovering around 1.0900 at the start of the new trading week on Monday. The pair is holding last week’s corrective downside, allowing traders to take a sigh of relief amid a broad US Dollar retreat. Focus shifts to Germany’s IFO survey for fresh trading impetus.

If the pair continues the uptrend to the range of 1.0960, it is expected to continue the uptrend to the range of 1.1028.

On the other hand, If the pair continues the downtrend to the range of 1.0835, it is expected to continue the downtrend to the range of 1.0778.

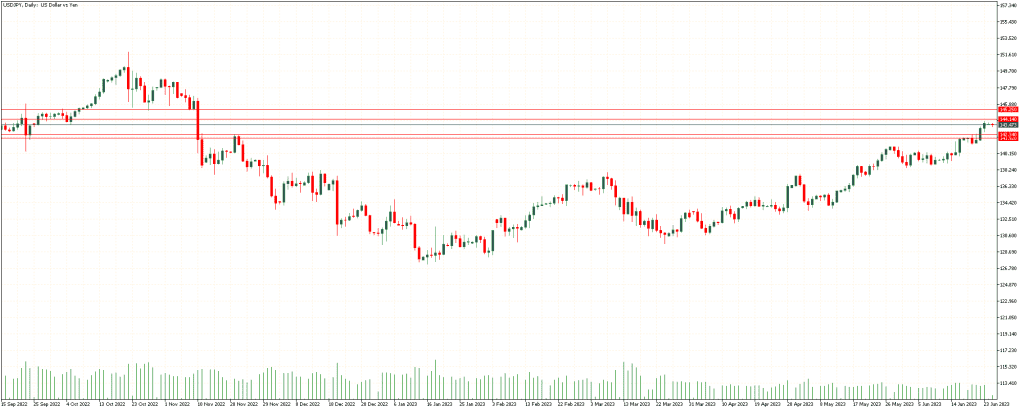

USDJPY

USD/JPY rebounds from intraday low but fails to gain upside momentum around 143.50 during early Monday. In doing so, the Yen pair prints the first daily loss in three while retreating from the highest levels since November 2022.

if the pair continues the uptrend to the range of 144.14, it is expected to continue the uptrend to the range of 145.25.

On the other hand, If the pair continues the downtrend to 142.34, it is expected to continue the downtrend to 141.92.

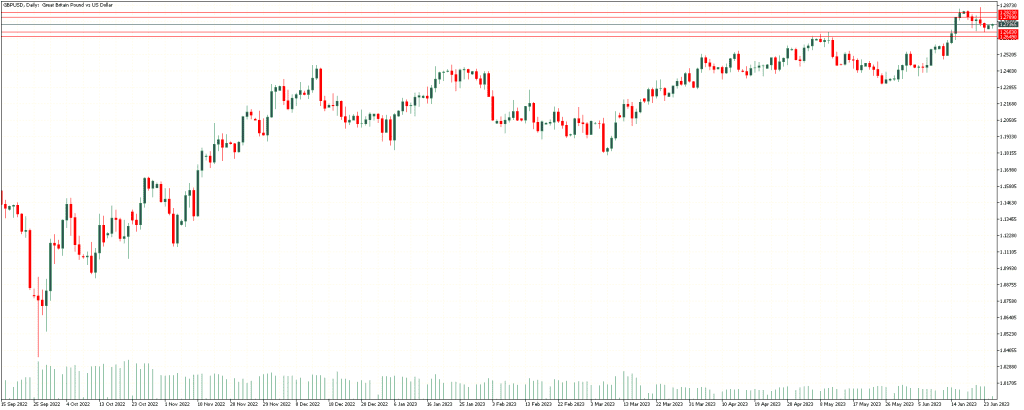

GBPUSD

If the pair continues the uptrend to the range of 1.2789, it is expected to continue the uptrend to the range of 1.2823.

On the other hand, if the pair continues the downtrend to 1.2683, it is expected to continue the downtrend to 1.2649.

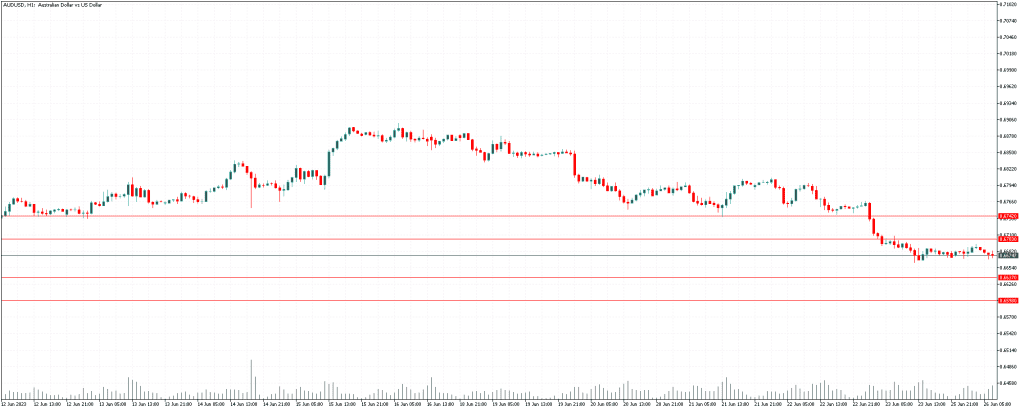

AUDUSD

The AUD/USD pair attracts some buying on the first day of a new week and recovers a part of Friday’s heavy losses to its lowest level since June 8. Spot prices climb back closer to the 0.6700 round-figure mark during the Asian session, though the uptick lacks bullish conviction.

If the pair continues the uptrend to the range of 0.6703, it is expected to continue the uptrend to the range of 0.6742.

On the other hand, if the pair continues the downtrend to 0.6637, it is expected to continue the downtrend to 0.6598.

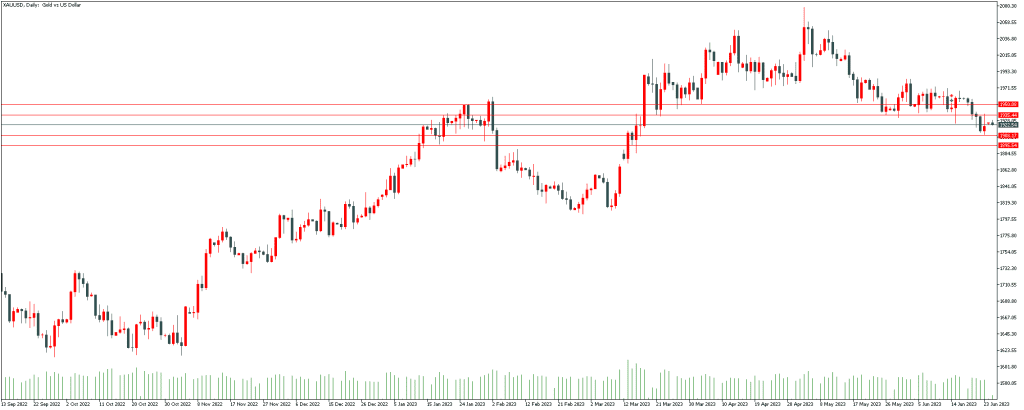

XAUUSD

Gold struggles to defend the corrective bounce off a three-month low marked in the last week, retreating from intraday top of late, amid mixed concerns about Russia and China.

If the pair continues the uptrend to the range 1935.44, it is expected to continue the uptrend to the range of 1950.08.

On the other hand, if gold continues the downtrend to the range of 1908.17, it is expected to continue the downtrend to the range 1895.54.