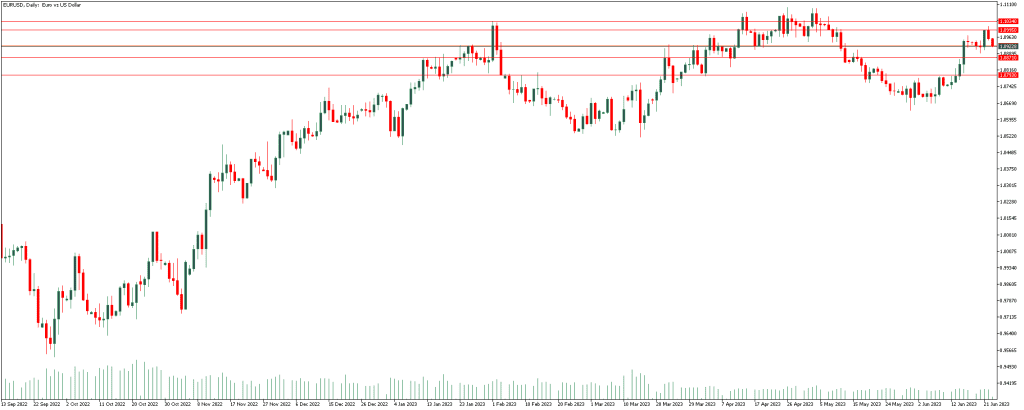

EURUSD

EUR/USD is extending the overnight correction from six-week highs above 1.1000, drifting toward 1.0900 early Friday. The Fed’s hawkish outlook and the risk-off impulse continue to underpin the safe-haven buck. EU and US PMIs in focus.

If the pair continues the uptrend to the range of 1.0995, it is expected to continue the uptrend to the range of 1.1034.

On the other hand, If the pair continues the downtrend to the range of 1.0871, it is expected to continue the downtrend to the range of 1.0793.

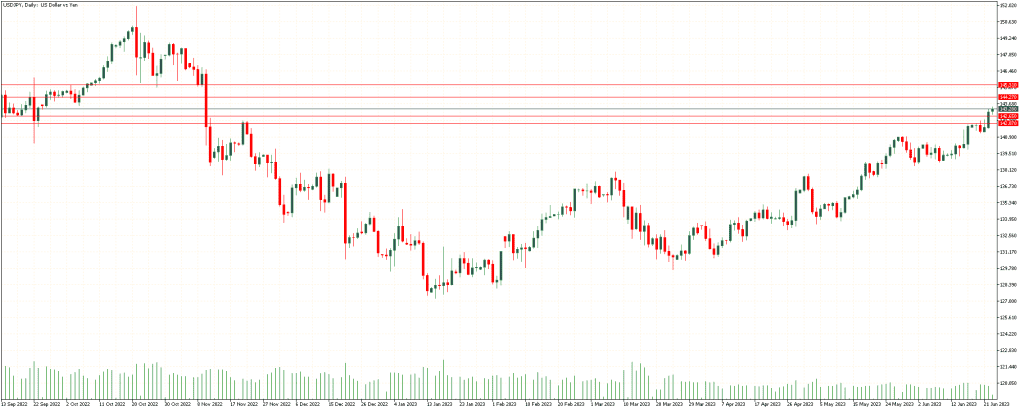

USDJPY

USD/JPY makes rounds to 143.00 amid a lackluster Friday morning in Europe, after refreshing the yearly top the previous day. In doing so, the Yen pair pauses the previous two-day uptrend amid an overbought RSI (14) line. Adding strength to the quote’s latest inaction could be the cautious mood ahead of the US PMIs and fears of the US recession.

if the pair continues the uptrend to the range of 144.27, it is expected to continue the uptrend to the range of 145.31.

On the other hand, If the pair continues the downtrend to 142.65, it is expected to continue the downtrend to 142.07

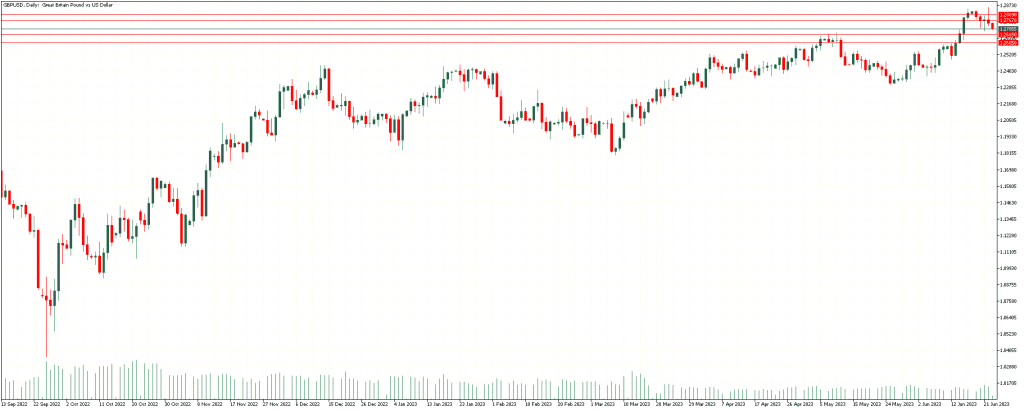

GBPUSD

If the pair continues the uptrend to the range of 1.2767, it is expected to continue the uptrend to the range of 1.2809.

On the other hand, if the pair continues the downtrend to 1.2665, it is expected to continue the downtrend to 1.2605.

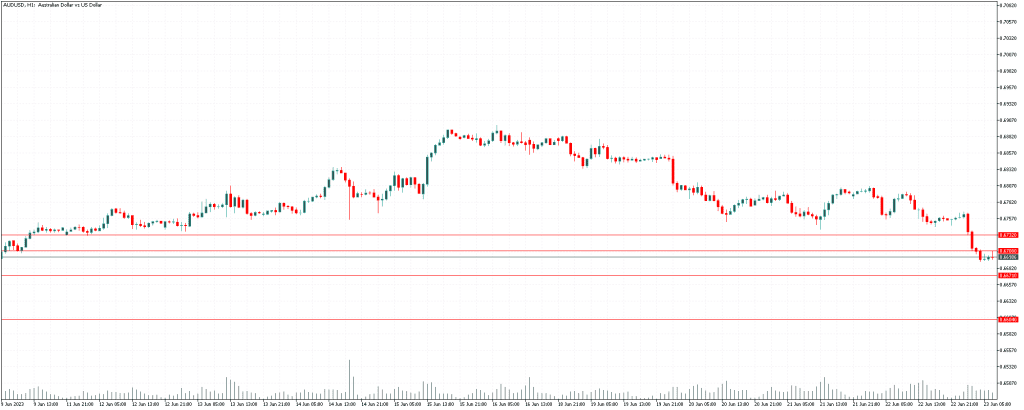

AUDUSD

AUD/USD is falling toward 0.6700, changing course after the Australian S&P Global PMIs for June came in mixed data early Friday. The pair is losing ground, as the US Dollar is extending its recovery amid intensifying risk-off flows on global economic concerns. Focus on US PMIs, Fedspeak.

If the pair continues the uptrend to the range of 0.6708, it is expected to continue the uptrend to the range of 0.6732.

On the other hand, if the pair continues the downtrend to 0.6671, it is expected to continue the downtrend to 0.6604.

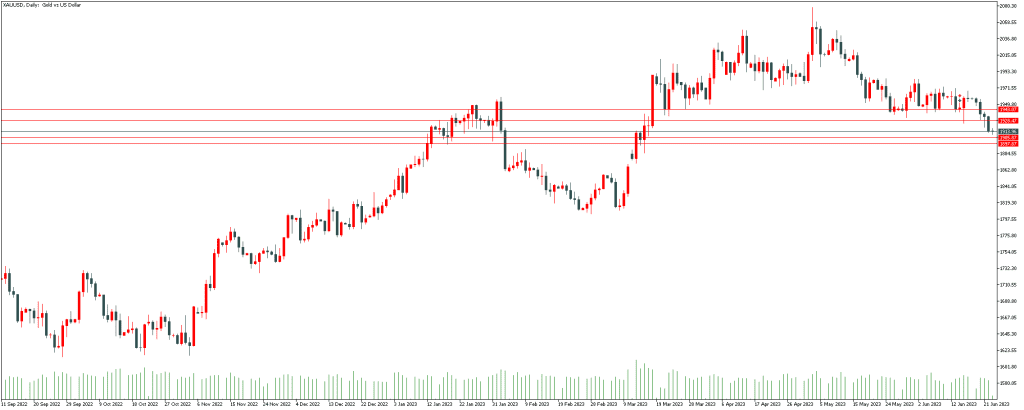

XAUUSD

Gold price remains on the way to posting the biggest weekly loss since late January as the US Dollar cheers the market’s risk-off mood, as well as the hawkish Federal Reserve (Fed) concerns. Central banks bolster recession woes and underpin US Dollar run-up, weighing on XAU/USD.

If the pair continues the uptrend to the range 1928.47, it is expected to continue the uptrend to the range of 1943.07.

On the other hand, if gold continues the downtrend to the range of 1905.87, it is expected to continue the downtrend to the range 1897.87.