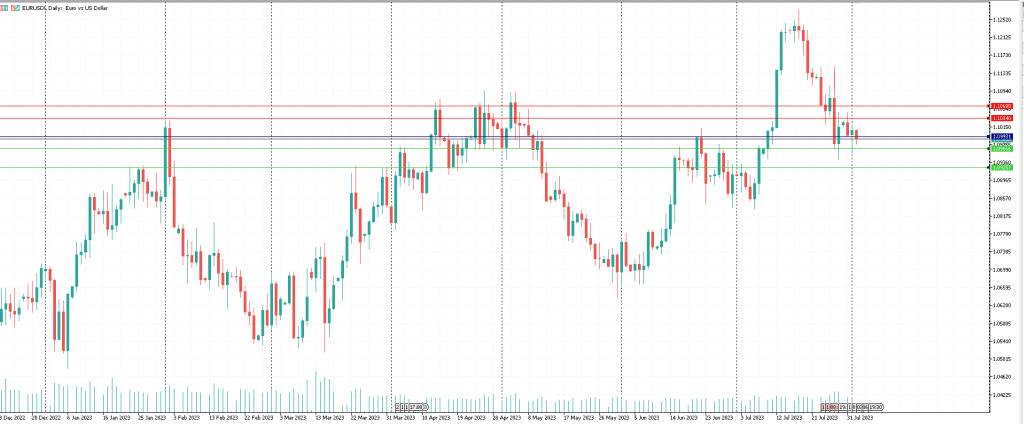

Euro – US Dollar

The EUR/USD pair holds a recovery gain near 1.1000 at the start of the European session on Wednesday. The pair finds support from broadly weakening the US dollar, as investors remain cautious amid the US debt downgrade and ahead of key US jobs data.

If it trades above the 1.09931 range, the growth is likely to continue to 1.10605. On the other hand, if it trades below the 1.09931 range, the fall is likely to continue to 1.09257.

US Dollar – Japanese Yen

USD/JPY holds lower grounds near 142.50, clings to mild losses amid early Friday morning in Europe after reversing from the highest level in a month the previous day. The Yen pair’s latest pullback could be linked to the market’s positioning for the US employment report for June, as well as a retreat of the US Treasury bond yields from a multi-day high marked the previous day. If the pair continues to trade above the range of 142.839 It is likely to continue climbing to 143.652. On the other hand, if the pair is traded below 142.839, it is expected to continue falling to 140.977.

USD/JPY holds lower grounds near 142.50, clings to mild losses amid early Friday morning in Europe after reversing from the highest level in a month the previous day. The Yen pair’s latest pullback could be linked to the market’s positioning for the US employment report for June, as well as a retreat of the US Treasury bond yields from a multi-day high marked the previous day. If the pair continues to trade above the range of 142.839 It is likely to continue climbing to 143.652. On the other hand, if the pair is traded below 142.839, it is expected to continue falling to 140.977.

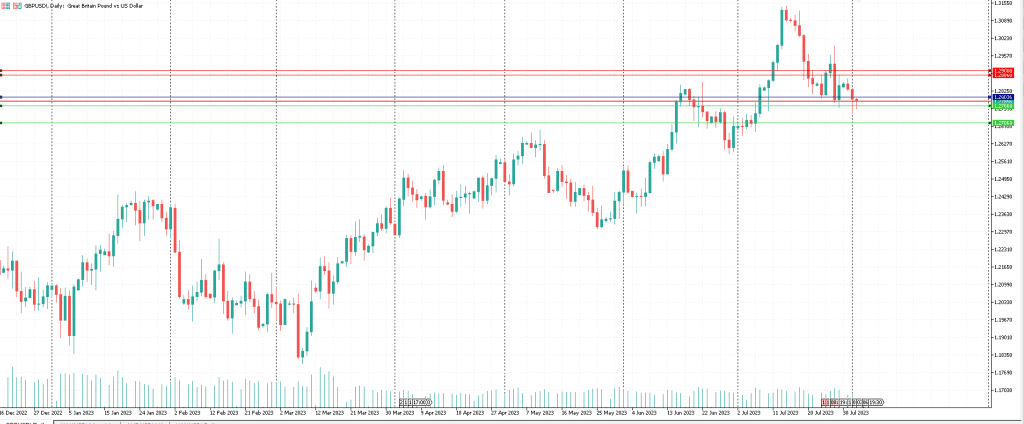

British Pound – US Dollar

The GBP/USD pair is trading below 1.2800, remaining on the defensive for the third consecutive day this Wednesday. The modest weakness of the US dollar has become a major factor weighing on major currencies. The downtrend appears to be limited ahead of the Bank of England’s decision on Thursday. US ADP coming.

If the pair is trading above 1.28037 it is expected to climb to the range of 1.28660 On the other hand, if the pair is trading below 1.28037 it is expected to fall to the range of 1.27064.

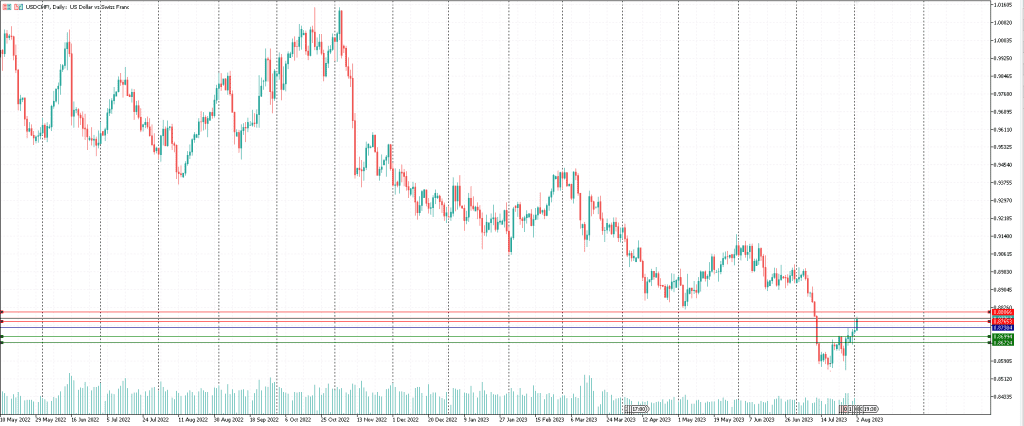

US Dollar – Swiss Franc

The USD/CHF pair rose in intraday levels while trying to correct the main medium-term downtrend, as the pair trades alongside the trend line, with negative pressure from the 50-day SMA, along with negative signals from the RSI afterward. Reaching overbought levels.

If the pair is trading above 0.87384, it is expected to climb to the range of 0. 88044 On the other hand, if the pair is trading below 0.87384, it is expected to fall to the range of 0.86994.

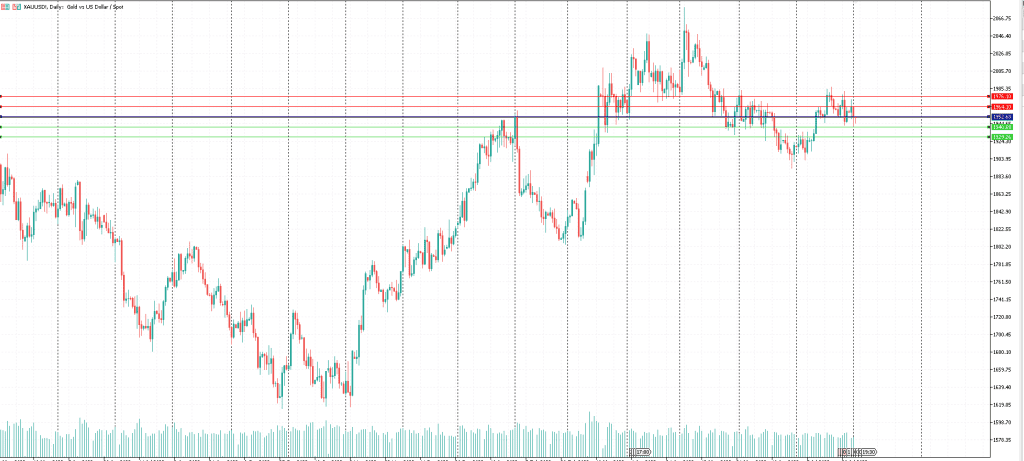

Gold – US Dollar

The price of gold is holding on to moderate gains as it rebounded from three-week lows. However, the current situation of the metal remains elusive to attract XAU/USD buyers as it remains below the key support level.

If the pair trades above 1952.68 it is expected to climb to the 1964 range On the other hand, if the pair trades below 1952.68 it is expected to fall to the 1935 range.